Available retail space hits 18-year low

Expanding brands are now contending with the biggest seller’s market in retail real estate in nearly 20 years, according to one of the world’s largest real estate services companies.

CBRE’s latest U.S. Retail Report states that a 10-basis-point decline in open retail space during the third quarter sent its availability rate down to 4.8% in the third quarter—the lowest it’s been since the company started tracking the market in 2005.

Net absorption increased by 34% to 9.8 million sq. ft. quarter-over-quarter, with CBRE’s “street retail, freestanding & other” segment posting the highest rise in occupied space of 4.3 million sq. ft.

The “power center” and “lifestyle & mall” segments turned positive in the third quarter after both recorded negative net absorption in Q2.

The nature of those positive results, however, reveal just how hard empty store spaces are to come by these days. Total net absorption in Q3 was just 52% of the 10-year quarterly average of 18.9 million sq. ft.

Some good news for retailers is that asking rent growth fell to just 2.1% on a year-over-year basis. And quarter-over-quarter rent growth fell to below the 0.5% level for the first time since 2020.

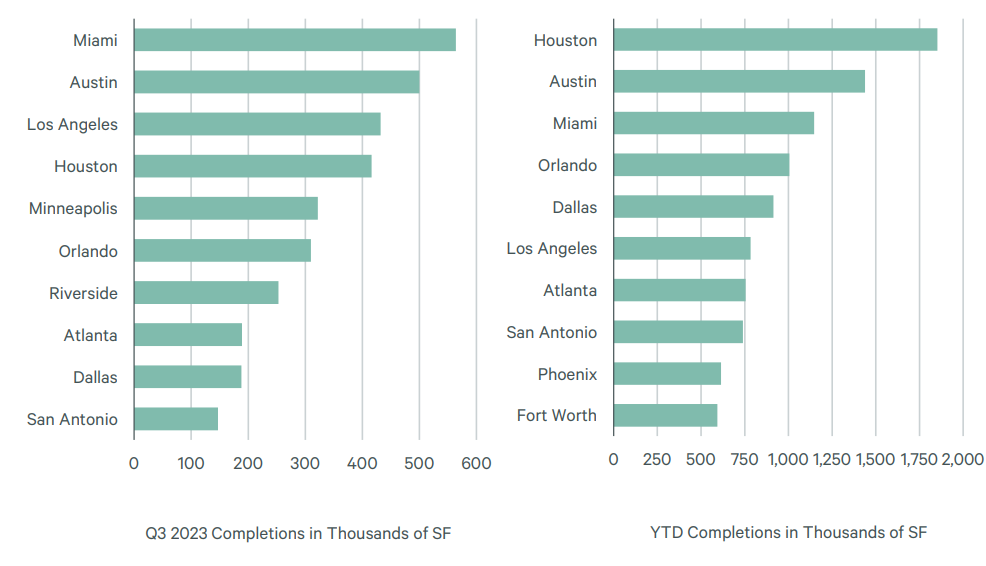

LEADING MARKETS FOR NEW CONSTRUCTION

Sun Belt metros led the nation in grabbed-up retail space, with Orlando being the most active market. It experienced 1.2 million sq. ft. of net absorption in the quarter, followed by Phoenix with 630,000 sq. ft. and Los Angeles with 600,000 sq. ft.

Orlando also paced the U.S. with year-to-date absorption of 2 million sq. ft. Phoenix and Houston came in second and third with totals very close to that mark.

New construction levels continued their fall during the quarter with a quarter-over-quarter decline of 28% to just under 5.6 million sq. ft.—the second lowest total on record. Noting that high construction costs will continue to delay development in Q4, CBRE predicts that 2023 will finish as the fourth consecutive year of record-low retail construction levels.

Sun Belt markets, though, will continue to rise above national trends, according to CBRE. The company’s research department reports that more than 5 million sq. ft. of retail space has been built so far this year in Houston, Austin, Miami and Orlando.