Off-price retailers, thrift stores grow share of apparel category

Consumers appear to be trading-down when it comes to buying clothes.

Off-price apparel retailers and thrift stores have been gaining visit shares since 2017, according to a new report from retail data firm Placer.ai entitled "Fashionably Frugal: Apparel in 2023." Off-pricers including T.J. Maxx, Marshalls, Ross Dress for Less and Burlington Coat Factory, received 47.4% of total apparel retail visits in 2023, compared to 38.9% for non-off-price stores. For thrift stores, it was 13.7% (up from 10.5% in 2017.)

In 2017, non-off-price apparel stores accounted for half (50.1%) of visits to these three segments, but the sub-category’s visit share has shrunk over time to 38.9% in 2023. Over the same period, off–price-apparel chains grew their visit share by 8.1 percentage points, from 39.3% to 47.4%, and the share of visits to thrift shops increased by 3.2% to 13.7% last year.

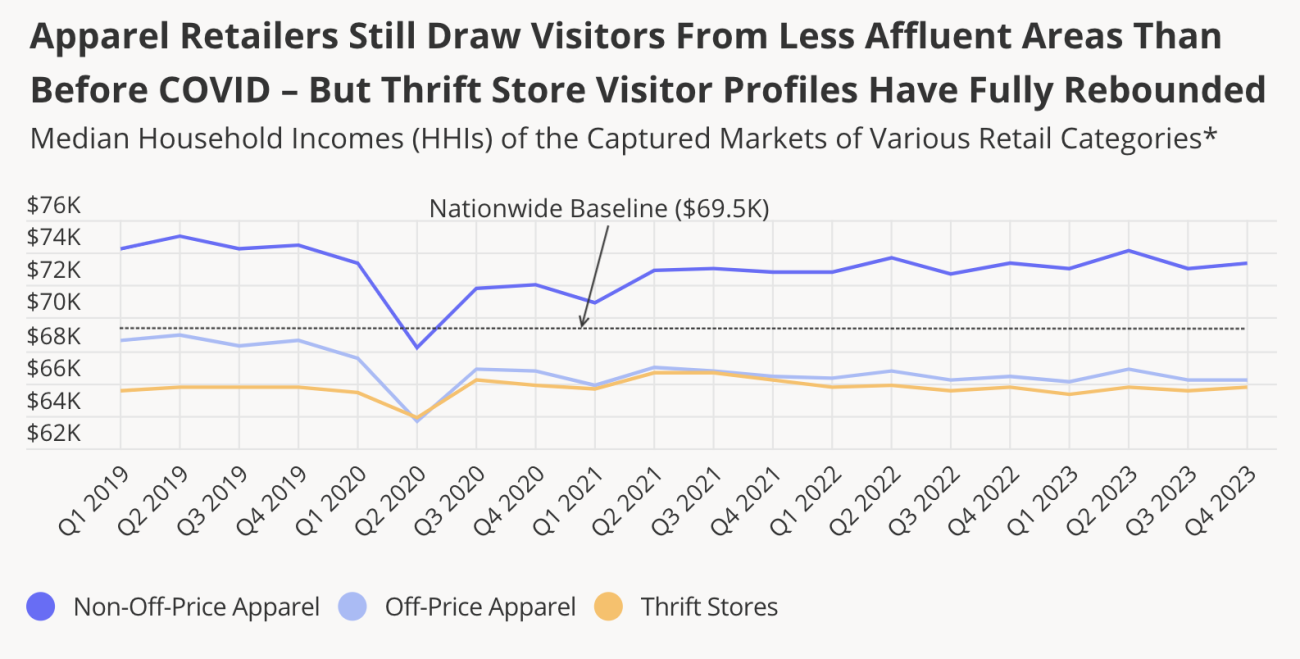

Despite the increased market share of off-price retailers and thrift stores, the apparel category is still divided by affluence. In early 2020, all three sub-categories experienced significant dips in the affluence of their captured markets following the onset of the COVID-19 pandemic. While thrift shops saw an immediate household income (HHI) rebound, non-off-price apparel chains, and even more so off-price retailers, have yet to see the affluence of their visitor bases return to 2019 levels.

When it comes to who is shopping at the three apparel sub-categories, Placer.ai found that while the income profiles of off-price apparel shoppers are similar to those of thrifters, their household composition is closer to that of visitors to non-off-price apparel stores. Visitors to off-price and non-off-price apparel stores were more likely to come from areas with higher concentrations of families with children in 2023, while thrifters were more likely to come from areas with smaller ones.

In 2023, households with children captured 28.9% of the non-off-price apparel market, 29.2% of the off-price apparel market, and 27% of the thrift store market. One-person households captured 26.1% of the non-off-price apparel market, 25.9% of the off-price apparel market, and 28.1% of the thrift store market.