Superstores, wholesale clubs had strong 2023

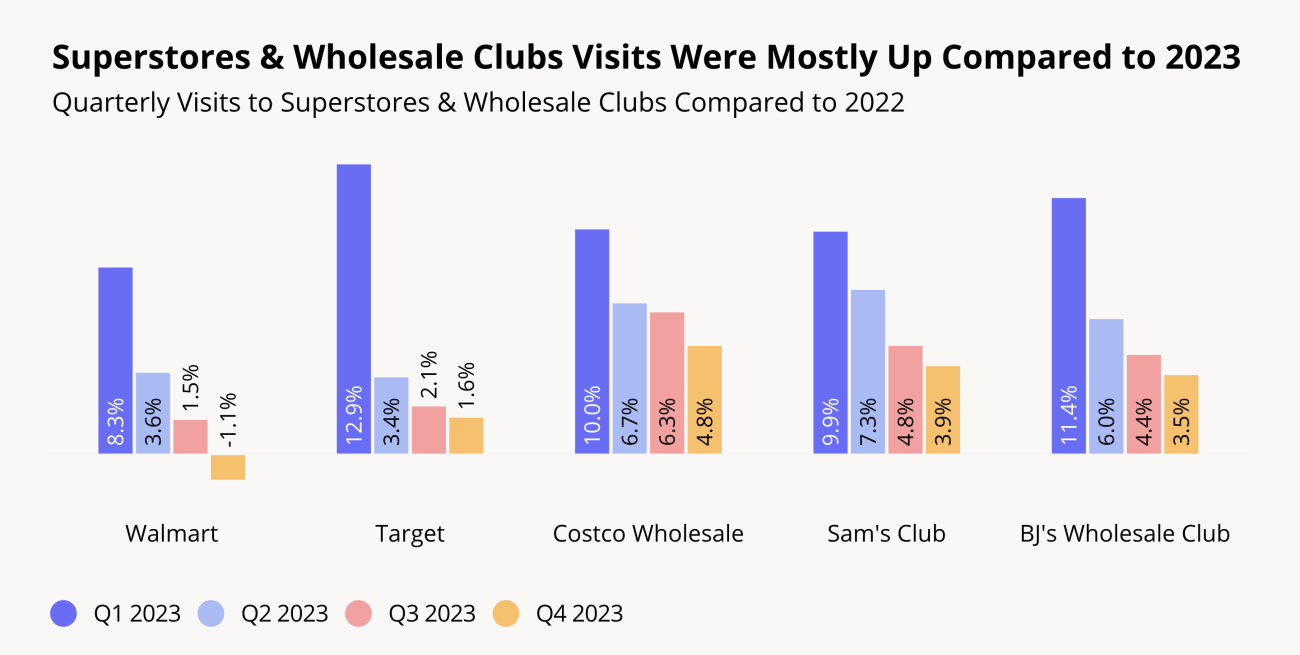

The five leading retailers in the offline "superstore" and warehouse club space performed well across the board in 2023, seeing consistent year-over-year quarterly visit growth throughout the year. But one company led the pack.

Costco came out on top in terms of overall YoY visit performance, followed by Sam’s Club and BJ’s Wholesale Club, according to a report from foot traffic data firm Placer.ai. The other two retailers studied — Target and Walmart — also saw quarterly increases in visits last year, though the Bentonville, Ark.-based giant suffered a slight dip in the fourth quarter. Visits to Target remained above the chain’s 2022 baseline during all four quarters, and Walmart mostly beat its 2022 visit performance.

Wholesale club chains Costco, Sam’s Club and BJ’s each saw visits increase throughout the year, partially due to attractive gas prices and consumers trying to stretch their budgets with bulk items, noted Placer.ai.

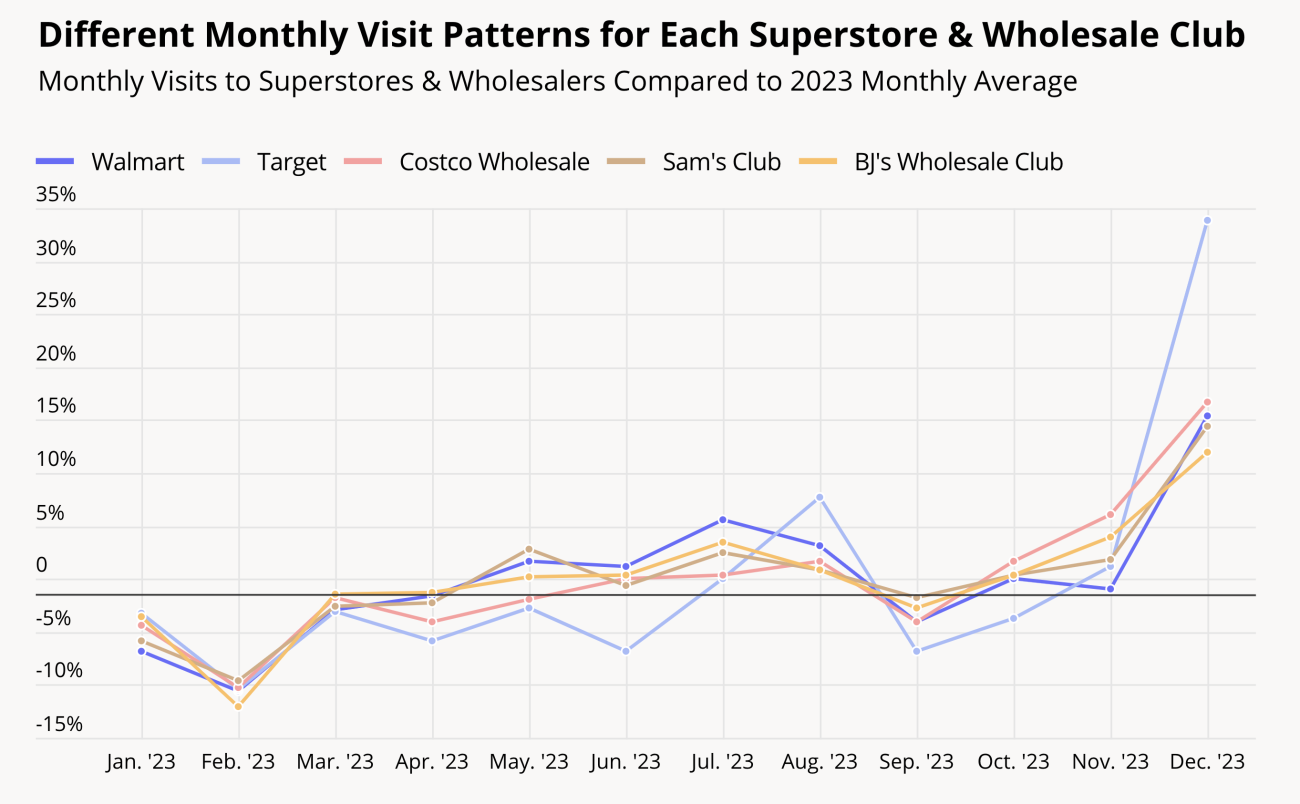

Costco kept up its momentum in January 2024. Visits to Target, Walmart, BJ's and Sam's dipped slightly compared to January 2023, which Placer.ai said could be due to comparisons to a strong first quarter performance last year or to post-holidays consumer cutbacks. In contrast to the subdued visit performance in the rest of the category, however, Costco foot traffic exceeded its January 2023 visit baseline.

While the five chains saw their monthly visits peak in December last year, Target experienced the most significant holiday peak, with a 33.9% increase in monthly visits compared to its 2023 monthly average, a number more than double the increases of the other four chains analyzed. Target also saw the strongest August visit growth relative to its 2023 monthly average as parents and students likely flocked to the chain in search of Back-to-School apparel and supplies.

In June and July, Walmart’s relative visit growth exceeded that of the other four chains. Wholesale clubs saw larger relative increases in November, which Placer.ai says could be because of Thanksgiving holiday shopping.

The trade areas of all five chains analyzed included a higher share of households with children when compared to the nationwide average. However, Walmart and Target also had larger percentages of one-person and non-family households when compared to the nationwide average, while the three wholesale clubs had smaller shares.

The trade areas of Walmart and of its subsidiary Sam’s Club had the highest share of Spatial.ai: PersonaLive’s small town and rural audience segments, including “Small Town Low Income,” “Rural Low Income,” “Rural Average Income” and “Rural High Income.”

Suburban segments were more distributed, as Walmart and Sam’s Club served a higher share of “Blue Collar Suburbs” while Target and Costco drew more “Wealthy Suburban Families.” BJ’s Wholesale Club received the largest percentage of “Upper Suburban Diverse Families.” The club chain’s trade area also included the largest shares of almost all the urban segments with the exception of “Educated Urbanites” – defined by Spatial.ai as “well-educated young singles living in dense urban areas working relatively high paying jobs.” Target came out on top in this category.

The full Placer.ai report can be found here.